AUTHORS

Andrea Casati

xTech Principal

@Bip xTech Italy

Alan Diego Quintal Pereira

Lead Data Scientist

@Bip xTech Brazil

Gabriella Jacoel

xTech Expert

@Bip xTech Italy

Niccolò Silicani

xTech Specialist

@Bip xTech Italy

Credit management process

Financial Services are undergoing a fast digital transformation, prompting banks to allocate an increasing share of their budgets towards IT. This change is mainly driven by Artificial Intelligence (AI) and Automation, reshaping the banking landscape. This change is mainly driven by Artificial Intelligence (AI) and Automation, reshaping the banking landscape. The introduction of AI into the financial industry is estimated to save banks $447 billion by 2023[1]. This article outlines how AI has affected the credit management process and some success stories that leverage this revolution.

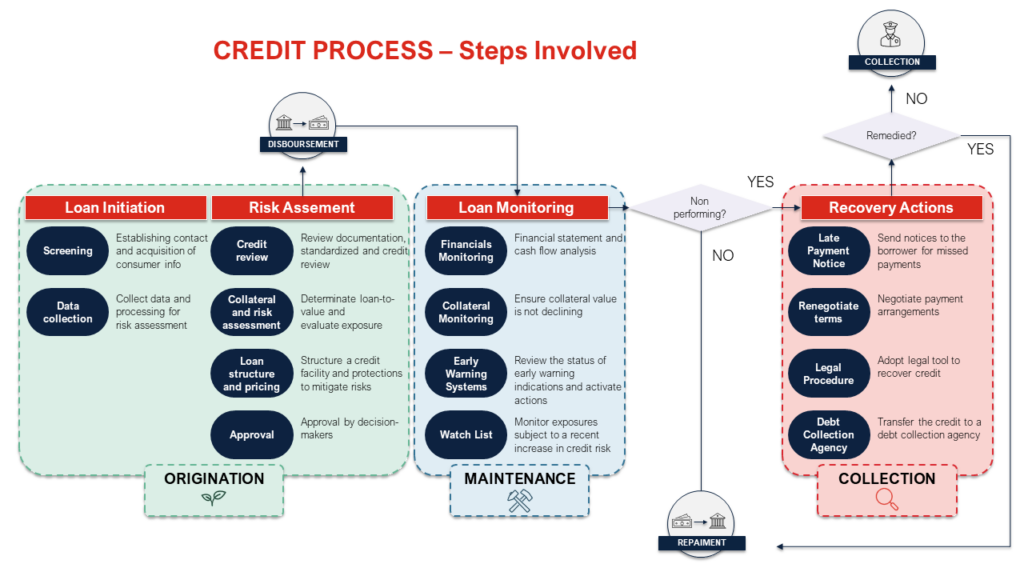

When a bank’s customer needs a loan, the financial institution activates a complex process, the credit management process, aimed at assessing the applicant’s credit risk and its effectiveness plays a crucial role in the bank’s ecosystem.

Figure 1

To meet regulatory requirements and mitigate risk exposure, banks estimate a set of indicators that provide a clear view of the borrower’s financial health and possible risks. Various data points (e.g., borrower’s characteristics) are used to feed econometric models to compute a score of borrower’s creditworthiness analytically.

Opportunities to thrive (or survive?)

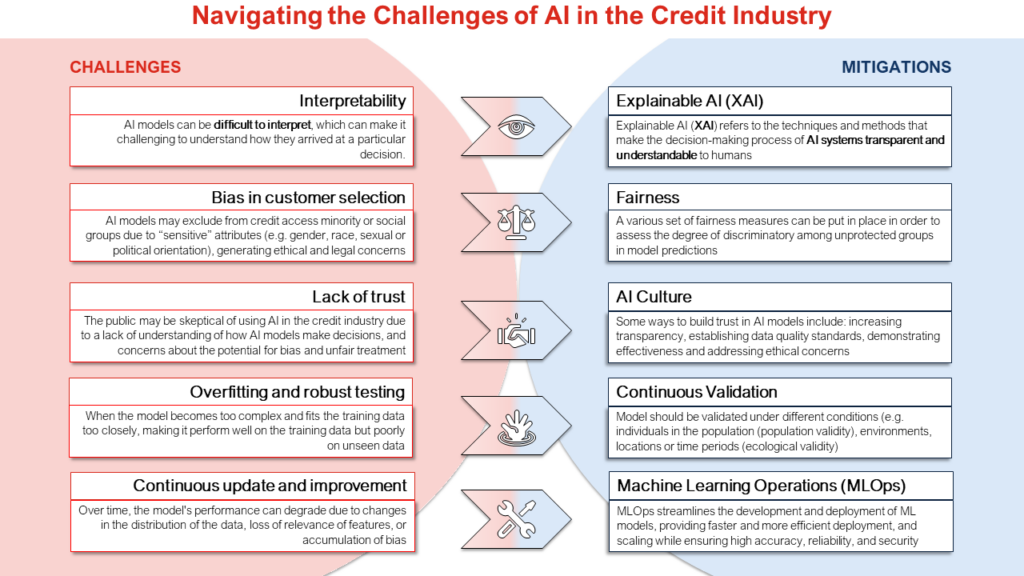

Traditional credit scoring is well established both in terms of understandability and compliance. The most widely used algorithm is the Logistic regression, thanks to its simplicity and interpretability of how the predicting variables determine credit risk. This algorithm makes it easier for companies to demonstrate compliance with financial regulations (such as the EU’s General Data Protection Regulation –GDPR– and the US Equal Credit Opportunity Act –ECOA-) and avoid potential legal issues. However, this model can’t capture complex situations and non-obvious relationships due to the critical assumption of the linear relationship between explanatory and target variables. Non-linear Machine Learning algorithms, such as XGBoost (a gradient boosting tree-based algorithm for predictive modelling), overcome this limit, discovering more complex patterns and consequently performing better in accuracy and robustness. One of the main concerns about using AI is that performance improvement is achieved by implementing black-box models, causing banks to be unable to provide a clear interpretation of model outputs. However, this is not a limitation any more. Thanks to last years’ improvements and the increasing maturity of AI, there are now specific mitigations (e.g., Explainable AI (XAI), see Figure 2) allowing companies to leverage the most powerful AI algorithms while addressing all ethical and compliance principles expressed in the AI Act (an EU proposal to set up a common regulatory framework for the use of AI responsibly and ethically) such as explainability, fairness, transparency, accountability, and non-discrimination. A recent survey[2] suggests that Italian banks agree on implementing an AI Governance Framework to oversee ethical and regulatory issues. Indeed, the most valuable business commodity is trust, especially in the relationship between the bank and the customer.

In addition, the recent large availability of Big Data and AI enables the enrichment of credit scoring models with new variables. Indeed, AI models allow processing not only structured (e.g., balance sheet data) but also unstructured ones (i.e., data without a predefined data model such as images or text).

In some cases, the credit process is carried out by relying on third-party solutions that use generic populations to develop credit risk analyses. The application of AI in banking allows for the enrichment of model inputs using the bank’s own internally generated. This new approach applying AI results in a more customizable solution for the lender and, simultaneously, more tailored to customers’ needs.

The evolution of the credit management process with these disruptive technologies creates a win-win situation for banks and customers, ultimately leading to a more efficient and fair lending process.

From the lender’s perspective:

- Increased Revenue: leveraging AI, it’s possible to improve the risk assessment process, increasing the quality of applicants, the loans being issued and the revenues.

- Reduced Risk: increasingly accurate risk profiling leads to a progressive reduction in the non-performing exposures (NPE) ratio.

- Operational efficiency: AI for credit scoring generates lower operative costs through process automation (e.g., by automating data entry, credit document processing, risk assessment, etc.).

- Improved customer experience: speeding up the process can improve service quality by improving loan approval time, yielding customer satisfaction, loyalty and ultimately, competitive advantage for the lender.

From the borrower’s perspective:

- Credit inclusion: Under traditional scoring models, some entities were excluded despite decent creditworthiness. AI enables a more accurate evaluation and allows access to credit for previously excluded borrowers.

- Convenient terms: better performance of AI models corresponds to better customer pricing. Banks can grant lower interest rates and more favourable repayment terms by assessing Risk more closely to the borrower’s actual ability to pay and incurring fewer costs.

- Faster loan approval: Process automation and efficiency optimise the response time to a customer, who, by receiving a loan decision sooner, can have more immediate access to funds.

Like all disruptive changes, these benefits come with potential challenges, such as bias in decision-making and lack of transparency. In the following schema main obstacles to AI adoption in the Credit Management Process are shown, associating a possible mitigation:

Figure 2

Open Finance

Up to now, we considered the data a Bank Institution has in-house or normally retrieves from info providers, but let’s assume that in the following years, thanks to the progressive introduction of Open Finance circuit, banks will have more data about financial behaviour of clients also in other financial institutions and those 3rd party stakeholders in the Open Finance circuit will have access to this information and will be able to produce verticalized and specialized models such as Credit Scoring ones, fostering competition in the Financial Services sector, with a potential benefit for the final Client.

Brazil is a leading country in Open Finance, and BIP just concluded an internal Hackathon[3] in partnership with a significant Open Finance Brazilian market player. For this initiative, eight teams developed two ideas on loan scoring and three on propensity scoring in general. After a POC phase, the winner’s idea is going to rapidly become a product to introduce competition in the Loans market via better user scoring.

Bip xTech can help

In the last decade, Bip xTech has helped clients worldwide implement AI in their credit cycle steps leveraging new modelling power and new alternative data. Our strength is not only about innovative technology but especially the availability of mixed teams of data scientists and credit process experts to support clients end-to-end: from vision to deployment, through planning, process re-design and technical solution implementation. As of now, we count more than 50 xTech data scientists (within a Global xTech community of more than 120 data scientists) specialized in models for credit risk, such as cross-selling credit risk models, behaviour models, probability of default, the lifetime probability of default, forward-looking credit risk, EAD, LGD, income estimation, risk rating models, and more.

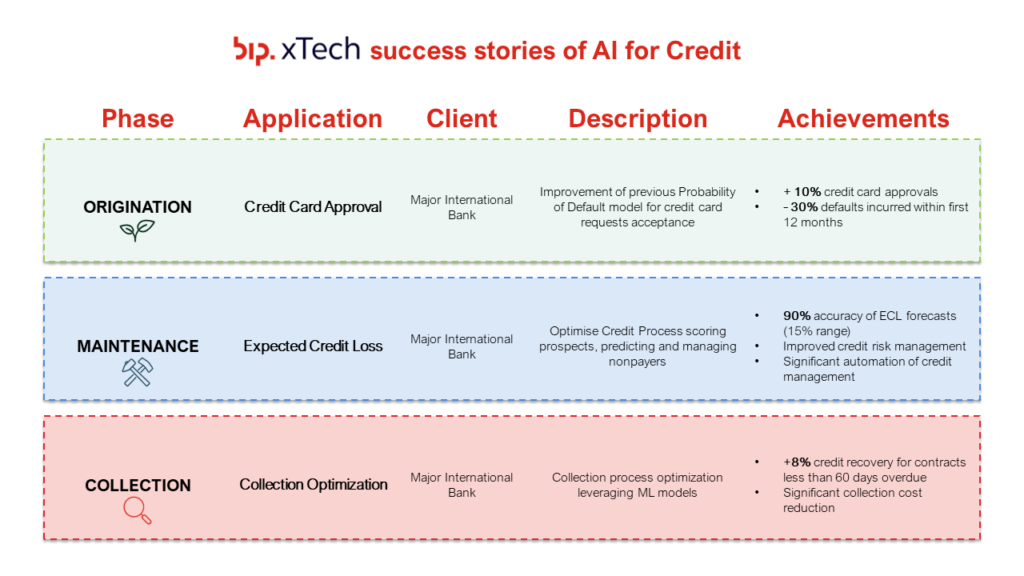

The following table shows a set of selected success stories (among the wide range of 40+ projects delivered recently), leveraging AI to implement solutions to support clients across the entire Credit Management Journey:

Figure 3

Case Study on Credit Card Approval

THE CHALLENGE

An international commercial bank needed to increase the approval rate of retail credit cards without increasing the riskiness of exposures. Previously the bank relied on a linear credit scoring model based on logistic regression to assess customers’ creditworthiness and was seeking a new approach to improve the performance by exploring more advanced statistical models.

OUR SOLUTION

The solution’s objective, released in production and integrated within the bank’s lending process, was to develop an AI model to predict the probability of default of the applicant within the first 12 months. After evaluating several nonlinear ensemble models, XGBoost was identified as the best-performing model.

The data, as well as the processing pipeline in place at the client, were not affected by the proposed solution. Adopting a non-intrusive approach, the task was entirely focused on selecting the best machine learning model without needing any data engineering on the existing information. Hence, the project could be implemented seamlessly and with minimal disruption to the current data infrastructure, maximizing efficiency and ease of use.

The model was trained and validated on a dataset ranging from 2013 to 2016, included more than 100 features and was released in production after eight weeks.

RESULTS

The proposed solution outperformed the previous model significantly and proved itself very stable across all months, leveraging non-linearity and ensemble techniques. It boosted prediction accuracy leading to a simultaneous increase in credit card sales while reducing bad credit ratios. In addition, explainability techniques allowed us to identify the most important variables: average quarterly deposit, number of months of service with the current employer, and monthly income making sure the model was ethically acceptable.

BENEFITS

- +10% credit card acceptance and sales

- -30% defaults incurred within the first 12 months

Conclusions

This article sheds light on how stakeholders involved in the credit process can benefit from AI. Banks can perform a more accurate risk assessment with clear financial gains. On the customer side, these new approaches promote inclusion in the banking system, ensuring that unbanked customers can access the credit market with favourable timing and terms.

As seen from the presented use cases, these technologies can be dropped into current business processes to generate value for both the lender and the borrower.

All disruptive changes generate challenges and opportunities. There are some requirements on the ethical and regulatory levels that must be addressed. AI-powered solutions inextricably link the future of Credit Management, and Open Finance’s advent will further accelerate this. Mitigations mentioned in this article enable harnessing this technology by considering ethical issues as a priority, paving the way for the responsible adoption of AI in the credit industry. Bip xTech can help thanks to relevant experience in AI and specifically in AI-based Credit management related algorithms.

To request further information about our end-to-end offerings or to have a conversation with one of our experts, simply send an email to [email protected] with the subject “AI for Credit”, and we will get in touch with you immediately.

[1] Digalaki, E. 2022. The impact of artificial intelligence in the banking sector & how AI is being used in 2022. https://www.businessin sider.com/ai-in-banking-report?r=US&IR=T

[2] ABI Lab, L’intelligenza artificiale nelle banche, Le nuove sfide, tra strategia e governo, Rapporto AI Hub gennaio 2023

[3] See linkedin post: https://www.linkedin.com/posts/bipbrasil_openfinance-artificialintelligence-businessintelligence-activity-7041518821622345729-sE4d

Leggi più approfondimenti